President Trump’s tariffs remain a controversial policy for U.S. businesses — and that’s apparently true for U.S. knife makers as well.

Soon after taking office this year, Trump levied tariffs, or taxes, on a host of goods and materials imported from other countries. But even brands making products in the U.S. still rely on foreign production for many materials. These components are often too expensive when sourced from the U.S. Sometimes, they’re unavailable from anywhere but countries like China.

That has put a strain on many outdoor gear brands, and it’s going to take a toll on the knife and tool industry, according to a 2025 survey from the American Knife & Tool Institute (AKTI). The survey confirms that “tariffs represent a threat to the financial stability and market performance of U.S. knife manufacturers, retailers, and importers,” the group said in a news release last week.

The vast majority of knife brands said that tariffs would increase costs. If the tariffs continue, most of the brands surveyed said they would have to raise prices to stay in business.

“This notion that these tariffs are paid by other countries — it’s just not true,” Mark Schreiber, vice president of AKTI, told GearJunkie. “We’re all trying to be thoughtful about how we go about this, but you can only absorb so much of this before you have to pass it on.”

Despite China Deal, Tariffs Remain Problematic

Last week, Trump reached a new deal with China over U.S. tariffs. After Trump threatened to raise tariffs to 100% on all Chinese goods, he met with Chinese President Xi Jinping to de-escalate the situation.

The new deal averts Trump’s threat, and instead extends a delicate truce between the world’s two largest economies for about a year.

However, the truce doesn’t substantively change the tariffs impacting the knife industry and many outdoor sectors, according to AKTI. Even after the new deal, knives from China are subject to an additional 20% tariff. Even more importantly, they’re still subject to the Section 232 steel tariffs that Trump enacted in February. Those steel tariffs demand an additional 50% tariff that remains in place even with the new deal.

Take the example of a $100 CRKT knife made in China. Under the current tariffs, CRKT has to pay an additional 50.4% on the total price of the product ($50.40). If the knife’s value includes $20 of non-U.S. steel, there’s a 50% tariff on that as well ($10).

“These are cost increases we would either have to absorb or pass some or all of that onto our customers,” said Schreiber, who serves as CRKT’s president, in addition to his role with AKTI.

Vast Majority of Knife Makers Impacted

The AKTI survey included responses from 50 U.S. brands making knives and/or multitools. Brand names were kept anonymous, but most of them are medium- and small-sized businesses. They include a mix of knife importers as well as brands conducting at least some of their manufacturing in the U.S.

The survey’s key findings include the following:

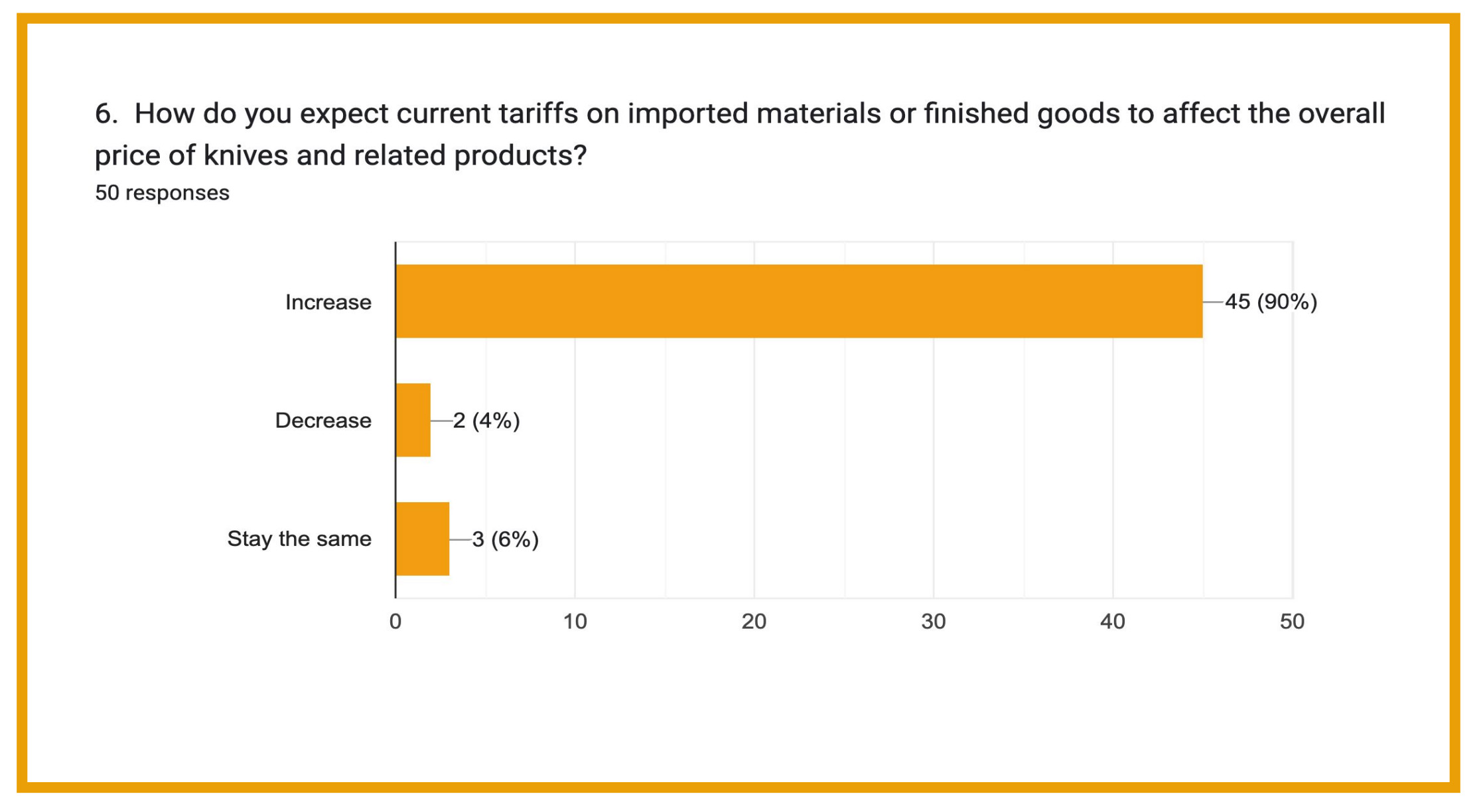

- 90% of respondents believe the tariffs will increase the overall cost of knives and related products.

- 66% of respondents anticipate passing these increased costs directly to consumers.

- 81% of respondents have already observed a significant change in consumer behavior, overwhelmingly reporting a demonstrable decrease in sales volume.

- 77% of industry participants believe the recent tariff increases will negatively affect the American knife industry.

CRKT, a frequently reviewed knife brand on GearJunkie, mostly imports knives from China and sells them in the U.S. Though Schreiber wouldn’t name a specific number for how much the brand has paid in tariffs this year, he said, “It’s in the six figures. It’s real money.”

If the tariffs continue, brands like CRKT will have to raise prices. That could make it even harder to entice American consumers, many of whom are already facing cost-of-living increases, rising inflation, and ballooning healthcare costs. “Knives to some degree are more of a discretionary purchase,” Schreiber said. “Knives can be a victim of people tightening their budgets for higher-priced groceries.”

Consumers Already Pulling Back

According to the survey, American consumers may already be doing exactly that. The vast majority of surveyed knife brands said they’ve already seen decreases in recent sales.

The situation is made more difficult because of a lack of information from the White House. About half of the brands said they were “not at all satisfied” about access to reliable tariff information. This chaotic environment began early in Trump’s second term, when he instituted what he calls “reciprocal tariffs” in April. The impact of these complicated taxes has had an even bigger impact than just the tariffs on steel, Schreiber said.

In many cases, knife brands are facing 20-40% tariff increases. For China, specifically, tariffs for some U.S. brands importing materials or other goods could rise to 50% or more. That’s just not sustainable, Schreiber said. Moreover, it doesn’t give U.S. brands sourcing from China enough time to move production back to the U.S. In the short term, they could cause many smaller brands to go out of business, he said.

He also pointed out the long-term ramifications of not changing the tariff policies soon. Trump also hiked up tariffs during his first term, and most of those tax increases continued through the Biden administration and now seem like the new status quo.

“The thing about tariffs: They don’t typically get rolled back,” Schreiber said. “So when prices go up, they stay up, because the tariffs aren’t going to go away.”

GearJunkie reached out to several other knife brands for additional comment, but didn’t hear back.

Read the full article here